June 2018

Tax – Personal Deductions

Tax – Personal Deductions

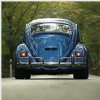

Car Expenses for Deduction

If you use your own car, including car lease or hire, in performing your employment duties, you can claim it as car expense. But if it is someone else’s car, you can claim direct cost, such as fuel, as travel expense.

Are you?

– Using your own car in performing your employment duties.

At a glance:

– If you use your own car, including car lease or hire, in performing your employment duties, you can claim it as car expense.

You should:

– consider whether to use your own car at work.

– Contact us if you require any clarification or advice.

You can claim a deduction for work related car expense if you use your own car in performing your duty as an employee. (i.e. Attending conference and meeting or delivering items/collecting supplies)

If you received an allowance from your employer for car expenses, it should be included in your tax return as assessable income.<

You can’t claim deduction on travel cost between home and workplace.

From 1 July 2015, you can either use:

Cent per kilometre method

- You can claim 66 cent per kilometre for your 2016-17 income year.

- You can claim a maximum of 5000 kilometre per car.

- Records are not needed but you have to show how you worked out your business kilometre.

- Commissioner on Taxation will determine the rates for future year.

Logbook Method

- Expense is based on the business-use percentage.

- For business-use percentage, you should keep records in a logbook together with the odometer reading for the logbook period.

- There is a minimum of 12 weeks continuous period for the logbook period.

- You need written evidence for all other car expenses.

For more information, click here.

Remember:

– You can only use one method of deduction.

This article was published on 31/08/2018 and is current as at that date

Tax – Personal Deductions

Tax – Personal Deductions

Home Office Expenses

The Tax Office provides a guide to assist individuals to correctly claim a tax deduction for home office expenses…

Are you?

– An individual who works as an employee and is required to use your computer, phone, or other electronic devices for work purposes?

At a glance:

– The Tax Office provides a guide to assist individuals to correctly claim a tax deduction for home office expenses.

You should:

– Remember that home expenses that you can claim must be required to use for work purposes.

– Contact us if you require any clarification or advice.

Taxpayers can only claim a deduction for home office expenses if he is an employee and is required to use his computer, phone, or other electronic devices for work purposes.

If the taxpayer performs some of his work from a home office, he may also be entitled to a deduction for the costs incurred to run the home office.

Running costs may include:

- Phone calls and phone rental related to work

- The cost of home office equipment (for items costing up to $300) or decline in value (for items costing $300 or more)

- Heating, cooling and lighting

- Repair costs to your home office furniture and fittings

- Cleaning expenses

Taxpayer must keep records of home expenses, records may include:

- Receipts for depreciating assets acquired

- Diary entries for small expenses ($10 or less) but whose total does not exceed $200, or expenses without evidence, regardless of involved amount

- Itemised phone accounts to determine work-related calls, or other records, such as diary entries (if you cannot obtain itemised account from your phone company)

- A diary you have created for work to determine how much you used you equipment, home office and phone for work purposes over a representative four-week period

For more information click here.

Remember:

– To keep records of the home expenses for work purposes to determine the amount to be claimed as deduction.

This article was published on 31/08/2018 and is current as at that date

Tax – Personal Deductions

Tax – Personal Deductions

Income and Deduction – Record keeping requirements

Throughout the financial year you’ll receive documents that are required for doing your tax, which you need to keep for five years from when you lodge your tax return in case of any validation of claims…

Are you?

– reporting any income or deduction in your tax return

At a glance:

– Throughout the financial year you’ll receive documents that are required for doing your tax, which you need to keep for five years from when you lodge your tax return in case of any validation of claims.

You should:

– understand what records you need to keep.

– Contact us if you require any clarification or advice.

Records you need to keep include:

- payment summaries from payers

- statements showing the interest you’ve earned

- dividend statements showing the dividend you’ve earned

- tax statements from managed investment funds

- receipts or invoices for equipment or asset purchases and sales

- receipts or invoices for expense claims and repairs

- receipts for donations or contributions

- loan documents

Reasons for records being kept include:

- records can be provided to the Tax Office if requested

- written evidence is required if total claim for work-related expenses is more than $300

- capital gains tax calculation needs the records that show original cost of capital assets you acquired

Records or documentation must be in English, unless expenses were incurred outside Australia.

For more information, click here.

Remember:

– To keep records or documents to prevent paying more tax than necessary.

This article was published on 31/08/2018 and is current as at that date

Superannuation – Employees & Members

Superannuation – Employees & Members

Small Business Superannuation Clearing House

From 26 February 2018, the Small Business Superannuation Clearing House is accessed via the Tax Office business portal…

Are you?

– running a business with 10 or fewer employees, or have an annual aggregated turnover of less than $10 million.

At a glance:

– From 26 February 2018, the Small Business Superannuation Clearing House is accessed via the Tax Office business portal.

You should:

– Start using the new SBSCH via your business portal.

– Contact us if you require any clarification or advice.

The Small Business Superannuation Clearing House (SBSCH) is a free service you can use if you are a business with 19 or fewer employees, or have an annual aggregated turnover of less than $10 million.

Through SBSCH, you can make a single electronic payment and then it will distribute the payments to each employee’s super fund.

From 26 February, the SBSCH is no longer accessible with a user ID and password authentication.

If you need to authorise someone else (such as a staff member or your accountant) to use the SBSCH on behalf of your business, you can grant them authorisation using AUSkey Manager.

By using the new SBSCH:

- You need to update any saved BPAY payment references in your internet banking or other banking services because the SBSCH bank account details have changed.

- You can make SG payments by credit card.

- You will be provided with a payment reference number for paying by BPAY, credit card or direct credit.

- You can save and manage multiple draft payment instructions, but only one instruction can be submitted at a time.

Remember:

– Update the SBSCH bank account details if you have saved BPAY payment references for your previous payments.

This article was published on 31/08/2018 and is current as at that date